Can a beginner read psychology of money

Yes, “The Psychology of Money” by Morgan Housel is typically seen as a helpful book for beginners. It looks into the emotional and psychological elements of personal finance and investment, offering useful insights for those new to the subject. The book highlights the value of knowing one’s personal connection with money and how it influences financial decisions. Many readers have found it to be a helpful and easily accessible resource for learning more about money and investment.

The book highlights that financial success depends on by your behaviour and thinking instead of expert financial knowledge.

- Simple language: It eliminates language and uses simple, understandable language.

- Storytelling approach: Financial ideas are shared using entertaining stories and experiences, making them more relevant.

- Short chapters: The content is divided into small portions, making it easy to understand without feeling overwhelmed.

Here are some things to keep in mind:

- Not a typical financial book: It does not discuss specific investing techniques or advanced investments.

- Focuses on the long term: The book highlights the need of patience, discipline, and long-term wealth development.

Is the psychology of money a good read

Yes, this is one of the greatest books to read on money. The book discusses:

Money is not the key to happiness: While many people feel that more money equals more happiness, research has revealed that this is not necessarily the case. Money can provide temporary happiness, but genuine happiness comes from relationships, personal development, and a feeling of purpose.

The Role of Values: People’s attitudes towards money are strongly linked to their values and beliefs. Understanding and integrating one’s values and spending patterns will lead to a better relationship with money.

The effects of early experiences: Early contact with money, such as education and cultural ideas, may have a major impact on how people view and handle money throughout their lives.

The risk factors of materialism: A concentration on wealth and money can lead to feelings of loneliness and disappointment with life, as individuals seek take advantage in outsiders.

The power of awareness: Being more thoughtful and purposeful with money may help people make better financial decisions, decrease stress, and improve their overall well-being

These results provide insight on the challenging connection between money and human psychology, highlighting the significance of knowing one’s own relationship with money in order to make sound financial decisions.

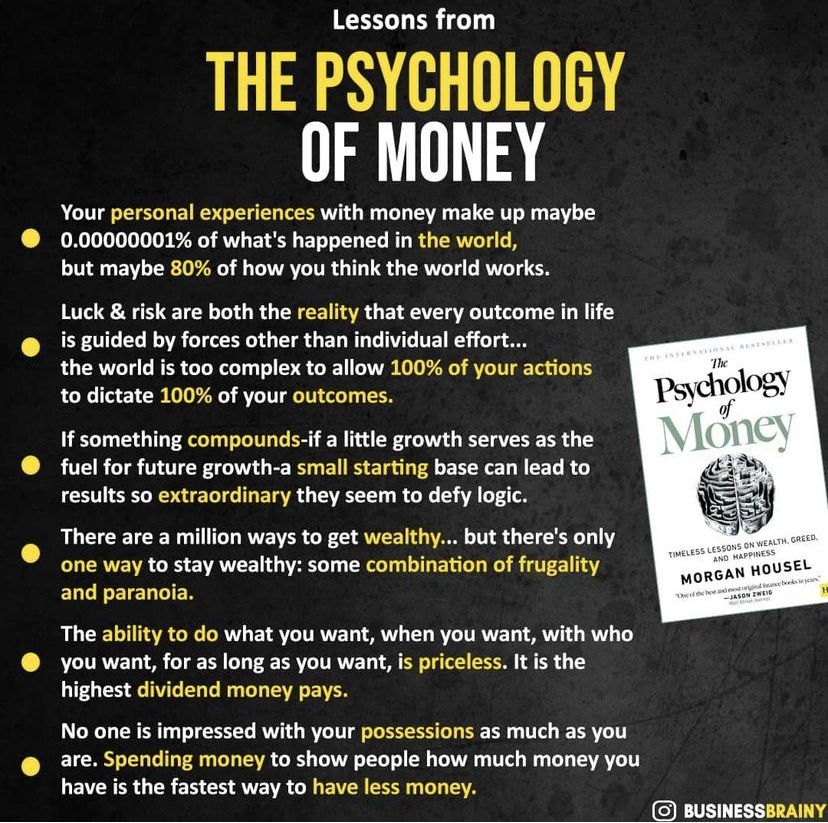

what is the message of psychology of money

Money’s Psychology: Beyond the Numbers

Avoid complicated financial calculations and market analysis. Morgan Housel’s “The Psychology of Money” claims that financial success is based on action rather than information. It’s important to understand how you think about and interact with money.

Here are some of the important ideas in this interesting book:

Emotions Rule: Housel issues the idea that people are completely logical financial entrepreneurs. We are vulnerable to fear, arrogance, jealousy, and community comparisons, which may all affect our judgement. The book identifies these biases and guides you through them for better decision-making.

Saving is necessary: A high salary is not a guarantee of money. Building money is more about maintaining your earnings and having them grow over time. “The Psychology of Money” highlights the importance of delayed enjoyment and sensible saving methods.

Luck and Risk: According to Housel, luck and risk have an important influence on financial outcomes. True, hard effort and knowledge are necessary, but unexpected factors can have a major impact. The book encourages you to be prepared for the unexpected and to build your tolerance for calculated risks.

Identity, Not Goals: Your approach to money should represent your values and personality. Instead of focused only on a single financial goal, “The Psychology of Money” encourages that you match your financial decisions with your important identity for long term success.

Freedom, Not Riches: The ultimate goal is independence from money, not excessive money. This means having the freedom and options to pursue what is most important to you, whether that is more time with family, travel, or a career change.

“The Psychology of Money” doesn’t provide an approach that is suitable for everyone. Instead, it provides a foundation for understanding your financial psychology and making more informed decisions for a secure and satisfying future.

Is the psychology of money a motivational book

The Psychology of Money: Motivation via Financial Wisdom.

Morgan Housel’s “The Psychology of Money” is not your typical motivational book full of inspiring financial statements. But its pages provide a powerful type of motivation: the kind that comes from knowing your connection with money and building a secure future.

Here’s why “The Psychology of Money” can be a game-changer

Increases the focus from getting rich to financial freedom : Many motivating materials promote the concept of huge money. “The Psychology of Money” changes the script. It inspires you to achieve financial independence, which allows you to live your life on your own terms rather than someone else’s. This independence may be quite inspiring since it allows you to follow your interests and live a meaningful life.

Very small Succeeds, Big Effects: The book highlights the importance of small, regular activities. Saving a little every month, making good investments (even if they’re little), and avoiding a lot of debt all help to ensure long-term financial security. Having these small wins add up creates a sense of success and encourages you to keep on direction.

Understanding Risk and Reward: “The Psychology of Money” knows that luck and risk are essential. This may be promoting since it motivates you to prepare for the unplanned and take measured risks to increase the value of your assets. It is not about being overly hopeful, but about making sensible choices with a realistic knowledge of potential results.

Building Resilience: Financial losses are common in life. The book prepares you to face these challenges with courage. Understanding your financial psychology and having a clear plan will enable you survive financial crises and come back stronger. This resilience is a powerful motivation because it helps you stay strong in difficult situations.

Long-Term Mindset: “The Psychology of Money” promotes a long-term approach to finances. It motivates you to focus on developing money slowly and regularly, rather than pursuing quick profits. This long-term vision may be quite inspiring, as you picture yourself moving towards a safe and fulfilled future.

While “The Psychology of Money” is not a book full of “go get ’em!”s, it does provide a more sustainable and inspiring approach to financial well-being. It provides you with the information and resources you need to make wise decisions, develop endurance, and achieve the financial independence that truly inspires you.

What does the book psychology of money talk about

Morgan Housel’s book The Psychology of Money explores the interesting the world of how our opinions and actions affect our relationship with money. It claims that financial success is more than simply data analysis and complicated strategies; it is also about understanding the psychology that behind them.

Here are some main concepts covered in the book:

Financial Behaviour over Financial control: Housel maintains that control of expert financial formulas is not the route to success. Instead, the book focuses on creating practices that promote saving, sensible investing, and avoiding emotional decisions with money.

The Strength of Later Appreciation: The book promotes the importance of saving constantly, even if in small amounts. It shows the power of added interest and how even small deposits may increase greatly over time.

The Role of Chance and Danger: Housel acknowledges that luck and calculated risks can play an important role in financial results. The book encourages you to be prepared for the unexpected and to make educated decisions while considering the potential hazards.

Financial liberty, Not Just Wealth: According to The Psychology of Money, the ultimate goal is to acquire financial independence rather than becoming very rich. This means having the freedom and options to pursue what you adore most in life.

Understanding Your Financial Psychology: The book promotes self-awareness in terms of money. Understanding your biases and how you think about money allows you to make better financial decisions that are in keeping with your objectives and vie

Housel says that financial planning should reflect who you are as a person, rather than your goals. Instead of focusing just on a single financial objective, the book advises that you match your financial decisions with your essential identity for long-term success.

The Psychology of Money does not offer a one-size-fits-all answer. Instead, it provides you with an outline for understanding your financial psychology and making intelligent choices that will lead to a safe and recognising financial future.

Why should I read psychology of money

Here are some compelling factors to read Morgan Housel’s “The Psychology of Money”:

Transform Your Money Mindset: Forget the need to get rich quickly. This book challenges conventional ideas of money and inspires you to achieve financial independence. It is about having the freedom to live your life on your own terms, instead of following someone else’s definition of success.

Effective Research, Without Excessive Theory: “The Psychology of Money” is full of helpful suggestions. You’re going to discover that small, consistent efforts like saving and making smart investments can produce enormous profits over time.

Develop Financial Resilience: Life gives you financial surprises. This book will teach you how to deal with losses in a positive manner. Understanding your financial psychology will help you recover from losses more effectively.

Make Smarter Decisions: Our emotions and impacts could impact our financial reasoning. “The Psychology of Money” teaches you how to identify these biases and build techniques for making educated financial decisions.

Build a Basis for Long-Term Achievement: This book is not a “find money fast” trick. It advocates a long-term strategy to wealth accumulation. You’ll discover the value of delayed pleasure and how regular behaviours may lead to financial stability in the long run.

Understand the Role of Accident and Danger: Great effort is not the only factor that determines the economy. “The Psychology of Money” highlights the importance of chance and unexpected events. This knowledge will enable you to make educated decisions while taking determined risks.

Easy and interesting Check out: Avoid boring business language. “The Psychology of Money” uses engaging stories and experiences to make financial ideas more relevant and entertaining.

Even if you’re financially educated, “The Psychology of Money” provides important insights that can help you improve your money management approach and reach your goals in life. It is a book that may help everyone who wants to have a better relationship with money and build a more secure future.

Who wrote Psychology of Money

Morgan Housel wrote “The Psychology of Money”. However, here is a little more details about the book that you could find interesting:

- Focusing on psychological factors: Despite typical economic books that highlight formulae and numbers, The Psychology of Money looks into the why of financial decisions. It investigates how our emotions, experiences, and views shape how we manage money

- Based with facts: The book is a collection of short, easy-to-read stories that explain various financial topics. This makes the content more interesting and relevant.

- Targets a wide audience: No matter your economic beginning, The Psychology of Money provides useful insights. It’s designed for everyone who wishes to have a healthy relationship with money.

- Highlights: Housel’s incidents indicate topics such as luck vs. talent in investing, the importance of delayed happiness, and the value of a long-term view.

If you want a personal finance book that is both useful and interesting, The Psychology of Money is a wonderful pick.

What is the conclusion of The Psychology of Money book

In conclusion, “The Psychology of Money” presents an in-depth study of the complicated chain of affects that impact our financial decisions. From the unexpected role of luck and risk to the undisputed power of saving and compounding, this book offers an advanced research of the concepts of money and success. It highlights the significance of behavioural control for financial wellness and promotes a change from money accumulation to wealth preservation. This book’s teachings have increased my understanding of money while also providing useful insights into how people act and our ideas of wealth and success.